The Deceptive Nature of Averages

By Generational Wealth Advisors

07/31/2018

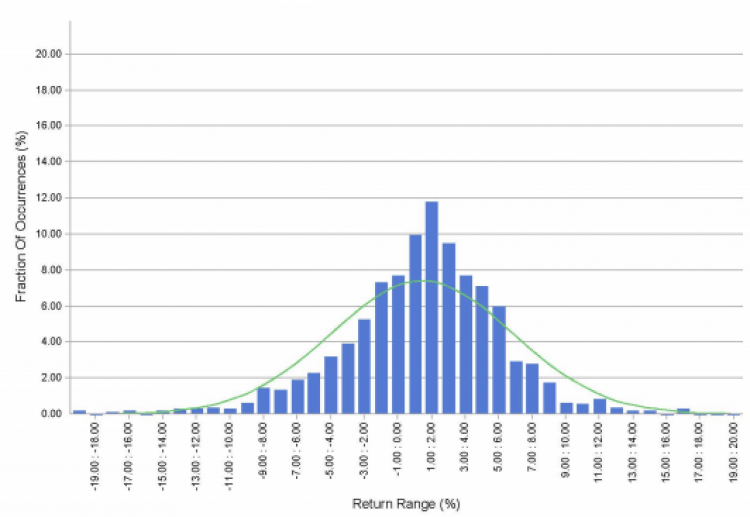

Averages can be useful when they measure traits or outcomes that are normally distributed in the familiar bell-shaped curve, where results cluster around the middle and we find a much smaller number of outliers at the high and low ends.

This type of distribution referred to as "normal" or "Gaussian" is often found in nature and physics. But, averages can be misleading or easily misinterpreted – as we’ve stated before, it’s possible for someone 6-feet tall to drown in a river an average of 3-feet deep. Complex non-linear systems often create outcomes with skewed distributions that result in even more confusion, and the behavior of capital markets certainly falls into this category.

Click here to learn more about this in our paper "The Deceptive Nature of Averages."